53+ how much of your mortgage interest is tax deductible

To determine how much. Web Most homeowners can deduct all of their mortgage interest.

Holy Roman Empire Europa Universalis 4 Wiki

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web If you took out your mortgage on or before Oct. Web The tax credit is equivalent to 10 of the purchase price of your home and cannot exceed 15000 in 2021.

So lets say that you paid 10000 in mortgage interest. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Ad Determine Your Rate Estimate Your Monthly Payment w Our Free Mortgage Calculator Tool. Web In 2020 the standard deductions were 24800 for a married couple 12200 for a single person and 18350 for the head of household. Calculating Lower Property Taxes.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web It allows taxpayers to deduct interest paid up to 750000 worth of principal on either their first or second residence. 13 1987 your mortgage interest is fully tax deductible without limits.

Web You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately. Ad File Your Own Taxes with HR Block Online and Get Your Maximum Refund Guaranteed. For mortgage loans existing on.

Web The amount you can claim as your mortgage interest tax deduction is 45000. And lets say you also paid. Web Heres how the mortgage interest deduction works and the guidelines and restrictions you need to know plus step-by-step instructions on how to claim it.

Web How much mortgage interest is tax deductible in 2023. 100 Bonus Depreciation Ends December 31 2022. The mortgage interest deduction is simply a tax deduction for the interest paid on your mortgage.

Homeowners who bought houses before. If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent. 16 2017 then its tax-deductible on.

Well Automatically Calculate Your Estimated Down Payment. Homeowners who are married but filing. Web The 2017 change to the current federal tax law limits the mortgage interest deduction a major tax break for homeowners.

Did Your Know You Can File Taxes Online with HR Block. Web The interest on the home equity loan would be deductible assuming your total loan balance on both your first mortgage and this home equity loan is no more. If you are single or married and.

Get Started On Your Return Today. The good news if you have a bigger mortgage is. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert.

Web For the 2019 tax year the mortgage interest deduction limit is 750000 which means homeowners can deduct the interest paid on up to 750000 in mortgage. This has been a severe blow to not-so. Home equity loan interest is deductible if the.

Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. US politicians presented the First-Time Homebuyer Act of 2021 on April.

Web If youve closed on a mortgage on or after Jan. Also if your mortgage balance is. How to Claim the Mortgage Interest Tax Deduction on Your Tax Return To claim the.

Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Web The new tax law has now lowered that 1 million limit to 750000 but only for new mortgages taken out after December 14 2017. However higher limitations 1 million 500000 if married.

Web Here is an example of what will be the scenario to some people.

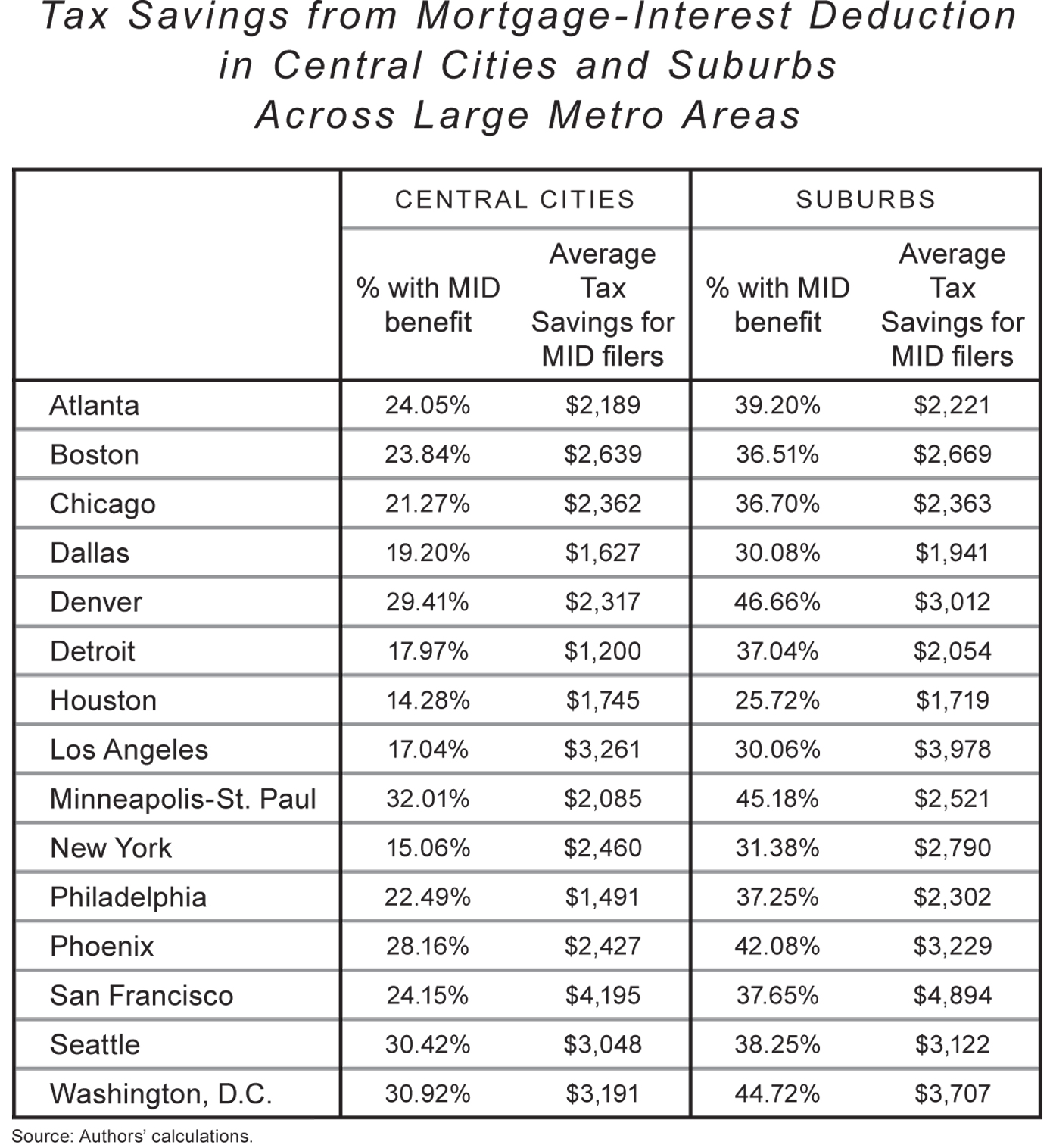

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Deduction Bankrate

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Changes In 2018

Can I Deduct Mortgage Interest On My Taxes Experian

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Rules Limits For 2023

Pdf Effect Of Microfinance Credit Terms On Performance Of Small And Medium Enterprises Case Study Of Mombasa County By Doreen Ndereba And Andrew Simiyu

Mortgage Interest Tax Deduction Smartasset Com

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction How It Calculate Tax Savings

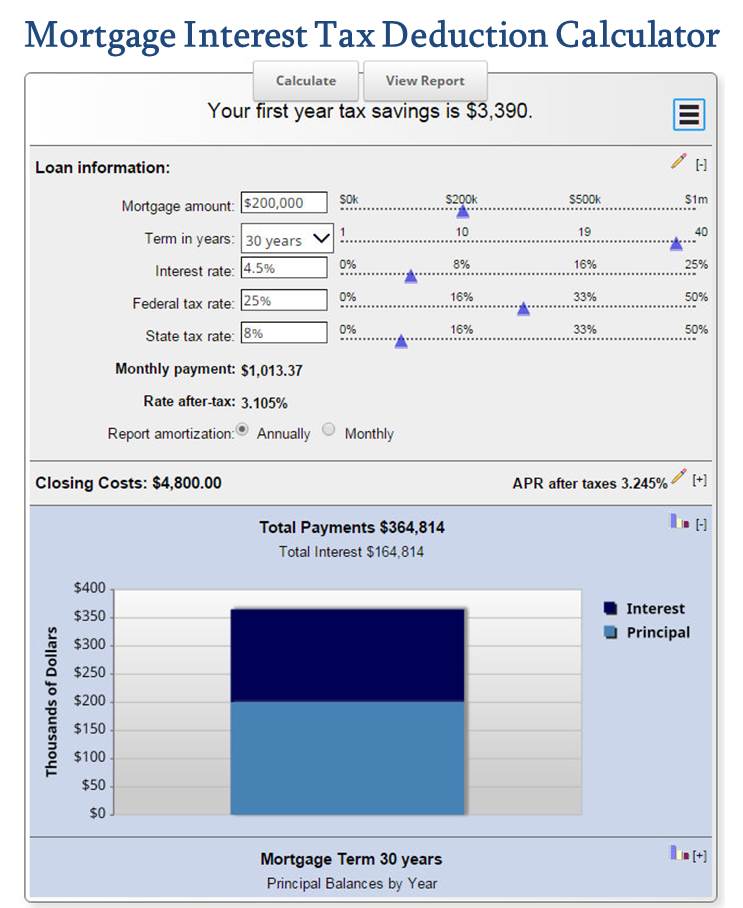

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Mortgage Interest Deduction Bankrate

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Mortgage Interest Tax Deduction What Is It How Is It Used

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid