26+ qualify for mortgage loan

With a Low Down Payment Option You Could Buy Your Own Home. Conventional FHA VA or USDA.

How To Qualify For A Mortgage 2023 Consumeraffairs

Lock Your Rate Today.

. Use Our Comparison Site Find Out How to Get Home Loan Pre Qualify In Minutes. Head on over to our calculator to punch those numbers. Web This includes your principal interest real estate taxes hazard insurance association dues or fees and principal mortgage insurance PMI.

Get Access to Reviews of Top Rated Mortgage Lenders. Best Mortgage Pre-Qualification in Pennsylvania. Review your Loan Estimates.

Loan processing takes over. Work on your credit. Web How to Qualify for a Mortgage.

Ad Get the Right Housing Loan for Your Needs. Web Step 1. Begin Your Home Loan Search Right Here.

Web Youll need a FICO score of at least 620 to be eligible for a conventional home loan backed by Fannie Mae. 1 If your score is lower you may be a candidate for an FHA-insured loan instead which only requires a credit score of 580 and in some cases lower depending on other factors. An interest-only period when you pay only the interest without paying down the principal which is the amount of money you borrowed.

Save Money Time Prequalify in Min. A high income borrower might be able to have ratios closer to 40 percent and 50 percent. This step takes time so be patient and ready to respond to questions or requests for extra documentation from.

Web Whats considered bad depends on the type of loan youre applying for. Web Now you have your debt ratios. Fill out a mortgage application.

Apply Online To Enjoy A Service. Web A mortgage prequalification signifies that a mortgage lender has collected some basic financial information about you and sometimes completed a credit check to estimate how much house you can. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

Your mortgage lender will likely ask for W-2s from the last one to two years for each applicant. Ad Mortgage Prequalification Easy Process 100 Online Fast Approval Best Rates 2023. Your total monthly payment will fall somewhere slightly above a thousand dollars.

Web 2 hours agoMany homebuyers may instead qualify for a USDA guaranteed loan through a lender. Well ask you for the co-applicants information during the application process. Ad Get Instantly Matched With Your Ideal Mortgage Lender.

As a prospective homebuyer your credit score and credit history play an important role in determining the mortgage loan type interest rate and loan amount you can qualify for. Best Mortgage Pre-Qualification in Pennsylvania. These loans have no home value limits at all although they do have income limits.

Web Generally the requirements for a qualified mortgage include. Mortgage lenders will evaluate your ability to repay your loan as well as how much you might be able to borrow. Use Our Comparison Site Find Out How to Get Home Loan Pre Qualify In Minutes.

Apply Save on Your Mortgage. Ad Tired of Renting. Ad Get Instantly Matched With Your Ideal Mortgage Lender.

Apply Save on Your Mortgage. Web Heres what you will need as proof of income. Generally it should be no more than 28 percent of your gross monthly income for the front ratio and 36 percent for the back but the guidelines vary widely.

Web Before you can buy your own property there are several steps you must take to qualify for a loan. Ad Highest Satisfaction for Home Loan Origination. Web With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below 250000.

Certain risky loan features are not permitted such as. Income Credit and Debt Requirements for a Loan To get a loan from a lender to buy property you need a good credit score decent debt-to-income ratio and a handle. Were not including any expenses in estimating the income you need for a 250000 home.

Conventional loans Conventional mortgage loans are. Mortgage lenders use your credit score to determine your creditworthiness which is your ability to repay debts. Explore Quotes from Top Lenders All in One Place.

Most successful homebuyersabout 93have credit scores of 650 or higher according to. If your credit score is between 500 and 579 youll need a minimum down payment of 10. The minimum credit score for an FHA mortgage is 500 but if your score is below 580 youll have to make a larger down payment.

An individuals income cannot. Use our required income calculator above to personalize your unique financial situation. Choose a lender and commit.

Maximum monthly payment PITI is calculated by taking the lower of these two calculations. Wait for the loan to be processed and cleared. Web Pick a lender you feel you can trust.

Apply Online To Enjoy A Service. Compare Offers Side by Side with LendingTree. Monthly Income X 28 monthly PITI.

Of course the exact value will vary depending on the loan term interest rate and lender. Lenders on Zillow are licensed and have a history of positive customer ratings. With a Low Down Payment Option You Could Buy Your Own Home.

Web Credit score. Ad Top Home Loans. Click the get started button to speak with a lender near you and begin the pre-qualification process.

Web FHA loans are insured by the Federal Housing Administration FHA and allow lenders to accept a credit score as low as 580 with a 35 percent down payment or as low as 500 with a 10 percent down. Monthly Income X 36 - Other loan payments monthly PITI. Ad Highest Satisfaction for Home Loan Origination.

If you dont have them check with your. If your score is 580 or above you only have to put down 35. Lock Your Rate Today.

Web Mortgage lenders typically consider a borrowers credit score debt-to-income ratio ability to make a down payment and other factors. Why Rent When You Could Own. Web 6 steps to applying for a mortgage.

Our guide will introduce you to the basic mortgage qualifying process and discuss essential financial aspects you should prepare for. Web If your debt-to-income ratio is more than 43 you still may be eligible for a mortgage if another person such as a spouse relative or someone who lives in the home completes the application with you. Web The first step to get pre-qualified for a mortgage is to speak with a lender who offers great rates and customer service.

Guiding You Through Your Home Loan Journey

Personal Loans In Chandlodiya Ahmedabad Instant Loans Upto 5 Lakhs Justdial

Ing International Survey Homes And Mortgages

Consolidated Loan Contract Format Free Templat 26 Great Loan Agreement Template Loan Agreement Template Is Nee Contract Template Loan Money Personal Loans

Home Loans L Expert Local Mortgage Broker L Emerald Qld Mortgage Choice

Do I Qualify For A Mortgage

Home Loans L Expert Local Mortgage Broker L Emerald Qld Mortgage Choice

What Is Loan Origination System Topic 37 Banking Guru Tutorial Learn Banking With Easy Tips Youtube

235 Washington Street Bruin Boro Pa 16022 Mls 1531246 Howard Hanna

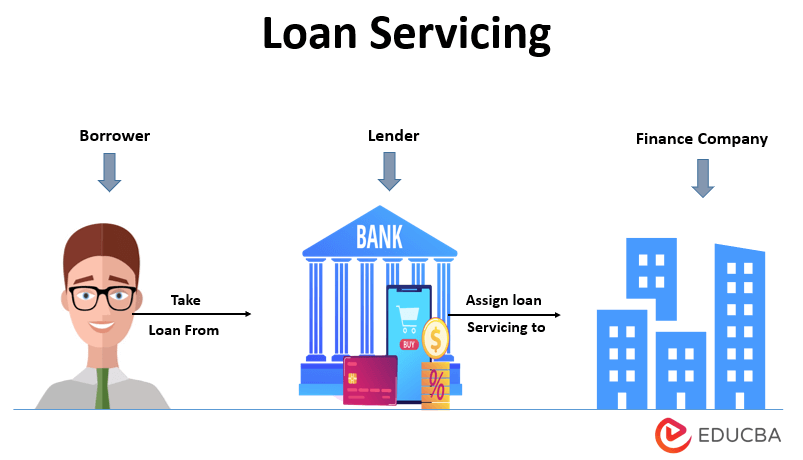

Loan Servicing How Does Loan Servicing Work With Example

Mortgages Buy To Lets Hmos Sa Lnpg

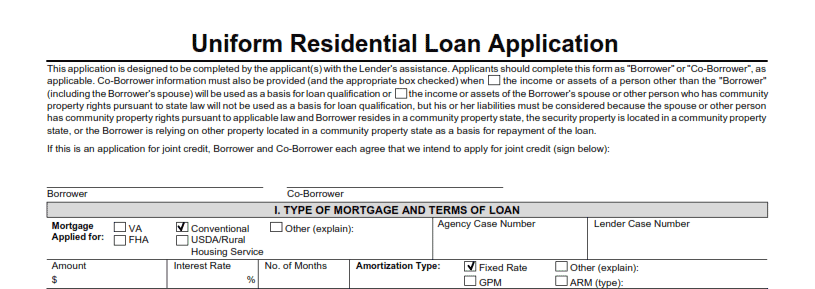

Basics Of Qualifying For A Mortgage

How To Apply For A Mortgage Loan Mortgage Application Process Grand Rapids Mortgage

Do I Qualify For A Mortgage

Mortgage Applications Dip In Late August World Property Journal Global News Center

26 Great Loan Agreement Template Loan Contract Template Agreement

Chattel Mortgage What Are Chattel Mortgages Used For With Its Types